Member-only story

Why You Probably Pay Cash When Buying Stuff You Don’t Need

We pay with credit to remember and cash to forget

We are rapidly moving to a cashless society.

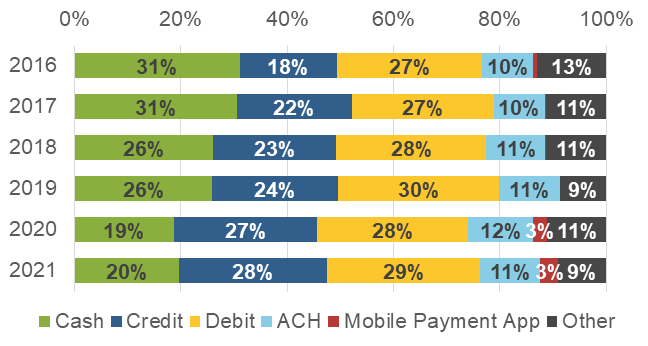

Research from The Federal Reserve Bank of San Fransico shows that the share of payments settled in cash has decreased from 31% in 2016 to 20% in 2021:

When you look at the chart, it’s clear that people are rapidly switching from paying with cash to paying with their debit/credit card.

Cash is less convenient than paying with a card, and, importantly, from a personal finance perspective, paying with cash makes tracking your spending more difficult than paying with a card that allows you to track every penny spent.

Interestingly, the fact that transactions are hard to track provides the only viable use cases for cash; it spares you the pain of remembering all the money you wasted on crap that you can’t justify buying.

We pay with a card to remember and cash to forget

In a 2023 study, researchers analyzed 118,042 real-world purchases and ran six separate experiments to…